Alibaba, a diversified technology company based in China, has been a key stock holding for us this year in Global Equity Funds. While originally known for its e-commerce platform, the company has significantly expanded into cloud computing, digital payments, and more.

Alibaba operates major e-commerce platforms, including Taobao (consumer-to-consumer), T-Mall (business-to-consumer), and AliExpress (a global marketplace for manufacturers). Its cloud computing arm, AliCloud, is among the largest globally and dominates the Chinese market. We believe it is well-positioned to benefit from the rapid development of artificial intelligence, supported by its cloud infrastructure and AI investments.

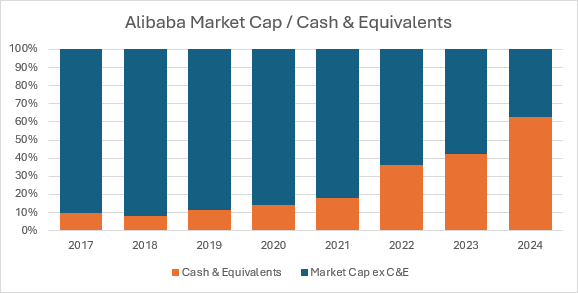

As China continues to navigate global trade issues, a decelerating GDP and market volatility, the country's economic landscape is evolving, with renewed government focus on domestic consumption and technological self-sufficiency. This has been seen with recent policy support which gave an initial boost to the economy – although this fizzled out as markets await further information on this support. While uncertainty remains, the focus from the government is clear that it intends to support its domestic market. Alibaba offers global investors broad exposure to these macroeconomic trends, while trading at a discount relative to its historical valuation. The company boasts a strong balance sheet, with nearly 40% of its market cap held in cash and a current PE ratio of approximately 12x.

In addition, Alibaba continues to enhance shareholder value. In Q2 2024, the company repurchased 630 million shares, amounting to $5.8 billion, reducing total shares outstanding by 2.3%. Management remains focused on improving profitability, projecting that loss-making segments will reach breakeven in the next 1-2 years.

Given these factors, we believe Alibaba is well-positioned for long-term growth and offers significant potential for investors looking to gain exposure to the Chinese economy.

Important Information

Past performance is not a guide to future performance. The value of investments may fall as well as rise and investors may not get back the amount invested.

The views expressed in this document are those of the fund manager at the time of publication and should not be taken as advice, a forecast or a recommendation to buy or sell securities. These views are subject to change at any time without notice.

This document is issued for information only by Canada Life Asset Management. This document does not constitute a direct offer to anyone, or a solicitation by anyone, to subscribe for shares or buy units in fund(s). Subscription for shares and buying units in the fund(s) must only be made on the basis of the latest Prospectus and the Key Investor Information Document (KIID) available at https://www.canadalifeassetmanagement.co.uk/